10 Simple Minimalist Budget Tips That ACTUALLY Work!

This post may contain affiliate links for your convenience. That means that if you make a purchase, I will receive a small commission at no extra cost to you. Read more here.

By now you have probably heard of minimalism, but did you know that you can also apply the principles of minimalism to your budget? You can use these ten minimalist budget tips to simplify your finances and free up your money and time for things that you really value.

It’s time to declutter your bad money habits and find peace in the simplicity that minimalist budgeting brings.

Now you can cash in on one of the biggest benefits of minimalist – more money in your pocket!

10 Best Minimalist Budget Tips

These tips to budget like a minimalist go way beyond simple frugal living, although of course living as frugally as an 80-year-old grandma can definitely save you money!

When it comes to applying the principles of minimalism towards your personal finances it literally pays to work smarter, not harder.

(See what I did there?)

Let’s say you were given a choice between two activities:

- For activity #1, you have to work for 30 minutes to save 50¢

- For activity #2, you have to work for 30 minutes but you make $50

Hands down you would probably choose to do the activity that will make you $50, right? It’s a no-brainer!

Your daily choices add up to big dollars.

If you want to make like a financial minimalist you need to get smart with how you spend your time (more on that in a minute).

Watch the minimalist budget video on YouTube!

1. Embrace your “weird”

Our society has become increasingly driven by consumerism, fast fashion, and mass consumption.

We are constantly fed the message that we need to acquire new and better things to feel happy and successful, both directly and indirectly.

This messaging has become so internalized that if you get serious about saving money, living simply, or begin to practice extreme frugality you are probably going to freak out the people around you.

Coworkers may be shocked that you choose to eat a boxed lunch rather than “grab a bite” with them.

Your friends might feel a bit put out when you decide you’d rather just stay in instead of catching the big game.

Even well-meaning grandparents may say your children “aren’t dressed well enough” or don’t have enough toys — as if the sign of a happy childhood is a toddler dressed in brand-name clothes and a playroom overflowing with toys!

They might say that you are too weird, too cheap, and being too careful with your money — that you deserve to have more fun.

Which usually means spending more money.

Stay strong and stick to your minimalist budget plan, even when you think people might be judging you for not keeping up with the Joneses — you don’t want to keep up with them anyway, because those folks are always broke!

Don’t end up buying something you will regret to try and impress anyone.

2. Reflect on your financial minimalist budget goals

What are you trying to achieve with your minimalism and/or budgeting journey?

Although there will be shared techniques and strategies – after all, these money tips can benefit almost anyone — it’s good to sit down and map out what you are ultimately reaching towards and how to get there.

You can simply take the time to sit down and reflect on this, either alone or with your partner, or you can write down your goals.

Considering that people who explicitly write down their goals are 10x more likely to achieve them, taking the time to jot down your scary-big goals can also help you figure out the baby steps you need to get you there.

Don’t skip this step!

3. Track & budget EVERYTHING

How can you know how much money you are saving if you have no idea what you are spending each month?

If you have never tracked your expenses before why not challenge yourself to track every single penny for 30 days?

That means every Starbucks coffee, every sneaky late-night Amazon purchase, every speeding ticket, EVERYTHING — if you have never done this before, you might be in for a surprise!

Once you have a clear idea of how much money you are spending each month, then you can create a budget that works for you and your lifestyle.

4. Slash expenses (hint, hint – the “big three”

Your first thought when you start budgeting might be to trim the small purchases you make every month, such as clothing, entertainment, Netflix subscriptions, etc.

Don’t get me wrong, those DO make a difference.

However, if you really want to save a big chunk of money you may find that the best place to start is the “big three” expenses.

What are the big three expenses?

The big three expenses together make up the three largest portions of annual consumer expenditures. My family is able to save 50-70% of our income because we focused on cutting back on spending here.

The big three categories are:

- Housing – 32.8%

- Transportation – 17.1%

- Food – 13%

This is where a minimalist lifestyle can really help with budgeting.

If you declutter your home you may find you don’t need as much space. If you don’t need as much space, maybe you don’t need as big of a home — and that means a smaller mortgage payment.

This is one of the reasons single people tend to spend less and save more money, simply because they don’t require as many things as a family with kids, even if they are minimalist kids!

This minimalist budget hack can slash so much from your monthly expenses!

Not to mention the money you can recoup from selling your clutter for cash (at one point I was making $1,000 a month as a stay-at-home-mom in between my kid’s naptimes!)

Cutting back on eating out and learning ways to cook cheap meals at home can save you hundreds, if not THOUSANDS, as well.

One of the best things you can do for your wallet is to learn how to take simple and inexpensive ingredients and turn them into healthy and tasty snacks and dinners with meal planning!

5. Think cheap & free

Why spend money if you don’t have to?

Nowadays there are entire online communities that exist for the sole purpose of exchanging free goods.

Reducing frivolous spending is not only good for saving money but also reduces environmental waste through sustainable buying habits.

You can even use free stuff that other people are giving away to decorate your home or apartment for free!

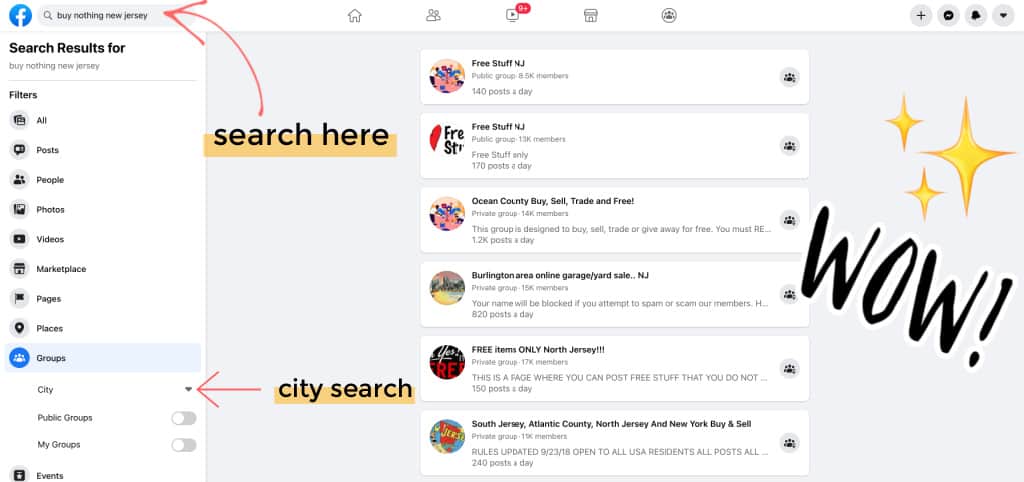

How to find a Buy Nothing group in your area:

- Go on your Facebook account

- Type “buy nothing” in the search bar

- You should get results to your local area

- Depending on your privacy settings, you may not see local results

- In that case, go lower and use the “city” to search locally

Each Buy Nothing group has its own set of rules, so make sure when you apply to join you read them carefully so that you don’t get kicked out!

6. Your time is money

Remember when you were given the choice between saving 50¢ and making $50 earlier?

Every day you make hundreds of thousands of micro-choices that determine how you spend your time.

Have you ever heard the saying, “Time is money“?

You buy things with your time, not just your money – this is Minimalist Budget 101! After all, small minimalist lifestyle changes can add up to big results over time.

If you start thinking about your time as a financial unit of measurement you might think twice about splurging on a new pair of Yeezy slides or that little Gucci dress.

Likewise, when it comes to saving money or making more money, think about how you can get the biggest ROI (return on investment).

I hated extreme couponing — it took me forever to hunt for the right coupons to save a couple of bucks.

I realized my time was better spent decluttering my home and selling my clutter, something that I actually enjoyed doing and that slowly freed up my time and money even more.

READ MORE: 70+ Decluttering Quotes to Inspire and Motivate You

7. Practice mindful spending

Have you ever decluttered your spending habits?

Minimalist shopping can be broken down into three phases:

- The pre-buy phase, where you are thinking about buying something

- The buying phase, where you are actively researching something to purchase

- The post-buy phase, where you reflect upon your purchases and learn from your spending mistakes

Are you a shopping addict who tends to make impulse buys or can’t resist getting the latest gadget?

If you are willing to hold a magnifying glass up to your spending and take a good, hard look at your habits you might learn a lot!

And your minimalist budget will thank you for spending less.

🌟 PRO-TIP: No matter how minimalist you are, you probably need to buy stuff again. Click here to sign up for Rakuten for FREE and as soon as you spend $25 you get a FREE $10 bonus as well as cashback on your purchase when you shop your favorite stores!

8. Increase your income

Everyone with common sense knows you can only cut so much from your budget before there’s nothing left to cut.

Call it an existence cost — we need food, shelter, clothing, and other necessities.

There are two good reasons to consider looking for ways to increase your income:

- You’ve cut EVERYTHING you possibly can and you are still in the red

- You already live frugally but you have dreams of financial independence, retiring early, or being your own boss

My parents passed away young and I’ve been on my own since I was 17 years old, so when I needed extra money that meant taking on a second or a third job!

Nowadays a lil’ ole thing called the Internet has made it much easier to create extra income, even if you want to work from home. Find the right side hustle for your lifestyle and schedule and you can create an extra $1,000-$3,000 a month or more.

Just remember that the easiest side hustles often pay the least while the ones that take more time to grow tend to be more lucrative in the long run.

9. Automate your savings & payments

Nothing will eat away at your hard work quite like late fees.

Take for example Chase Bank, which charges a hefty $39 late fee for any late credit card payments.

Compare that to their stingy savings account interest rate, which has a 0.01% APY (annual percentage yield), which means that even if you have $1,000 in your savings account with that interest rate you will only have an extra 10¢ in your bank account at the end of the year.

One single late fee and they ding you $39, but only give you $0.10 if you save?

Man, that sucks!

Make sure to keep enough money in your bank account that you never incur late fees and automate your bill payments so that you always pay your bills on time.

Just don’t space your payments and make sure to check in every once in a while to make sure everything is a-okay – you might catch an equally sneaky price increase!

10. Educate yourself

Imagine you could take all the knowledge of mankind and compress it into a small device, not much larger than a pack of cards — what would you do with that device?

Would you use it to expand your knowledge and learn new skills?

Or would you use it to watch brain-numbing TikTok videos and laugh at cat memes?

This isn’t science fiction, folks. There is so much free knowledge literally at your fingertips in your smartphone or home computer.

No matter if your goal is to get out of debt or become financially independent, the knowledge you need is often only a Google search away, at your local library in the personal finance section, or even in a personal blog like this!

The knowledge is there.

But it’s up to you to go after it and make the changes in your life you need to make!

HOW TO START BUDGETING NOW – AND WIN!

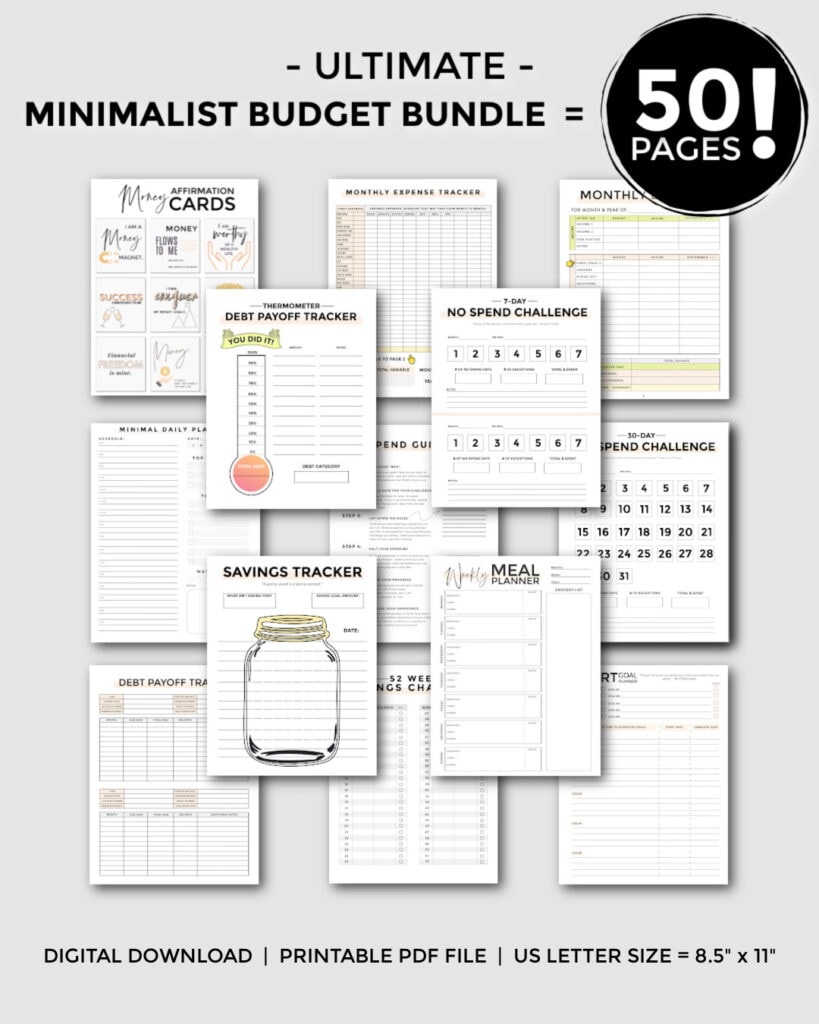

This 15-page minimalist budgeting binder is now available in my shop – click here to check it out.

It’s based on the money-saving that my CPA husband and I have been using for the past 10+ years to budget, save more money, and increase our income, including:

- eliminate $250k of debt in five years

- pay for our wedding and honeymoon, all cash

- move to Europe and buy our dream home

RELATED POST: 10 Best Minimalist Purchases of My ENTIRE Life

Now get out there and start budgeting!

I hope you enjoyed this post on creating your minimalist budget!

Comment below if you have any amazing BIG budgeting tips I missed. 🙂